The Home Loan Process

Demystifying Home Loans

If you haven’t experienced it before, the home loan process can feel overwhelming, but our agents will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, we partner with some of the best lenders in the industry, and we’d be happy to introduce you, so you’ll be taken care of.

NMLS ID # 2087180

Kim

Zavatsky

VP | Sr. Loan Officer

NMLS ID # 180794

- (520) 990-8810

- 4031 E Sunrise Dr, Tucson, AZ 85718

Kim Zavatsky worked as a financial consultant, tax preparer, and licensed realtor before discovering mortgage lending in 1992. She now proudly says working as a Loan Officer is her passion.

A graduate of the University of Arizona with a degree in finance, Kim has been fortunate enough to educate and assist all types of buyers—from seasoned purchasers to first-time homebuyers. No matter the client, she strives to make the mortgage process understandable and seamless.

With years of experience and attention to detail, Kim has been able to find solutions to financing issues that others have overlooked. She views each loan as a partnership, not just a transaction.

In her free time, Kim and her husband enjoy traveling, spending time with their two teenage children and two rescue dogs, and volunteering in the community. As a former marathon runner, she loves to hike, walk, and run when she doesn’t have too many aches and pains.

Let's Get StartedSteve

Zavatsky

Sr. Loan Officer

NMLS ID # 18083069

- (520) 247-3611

- 4031 E Sunrise Dr, Tucson, AZ 85718

Steve Zavatsky was an insurance agency owner for 19 years before joining his wife in mortgage lending in 2017.

Bringing what he learned from insurance, he’s able to help provide solutions, effectively communicate and cultivate lasting relationships with his clients.

Altitude Home Loans competitive low rates, in-house underwriting, and quick closing ability is a winning combination for his clients.

Let's Get StartedKnow Your Mortgage Payment

Based on the home's sale price, the term of the loan, buyer's down payment percentage, and the loan's interest rate, this calculator can help estimate what you'll need to pay out monthly for your new home. This calculator factors in PMI (Private Mortgage Insurance) for loans with less than a 20% down payment, as well as town property taxes and its effect on the total monthly mortgage payment.

Buying a home is a big step! Whether you're buying your first home, your dream home, or your tenth investment property, yours will be a big investment. We know how important this is to you and we have an army of experts to make sure we find the perfect property for your unique circumstances. Finding the perfect property is just one way we can help you with your real estate purchase.

In order to determine the amount of home you can afford a lender will use your debt-to-income ratio to determine the percentage of your pre-tax income you spend on debt. Your debt ratio will include: monthly housing costs, car payments, credit cards, student loans, and any other installment debt. If you take on more debt before buying a home it will have an impact on the amount of the loan that the lender will finance.

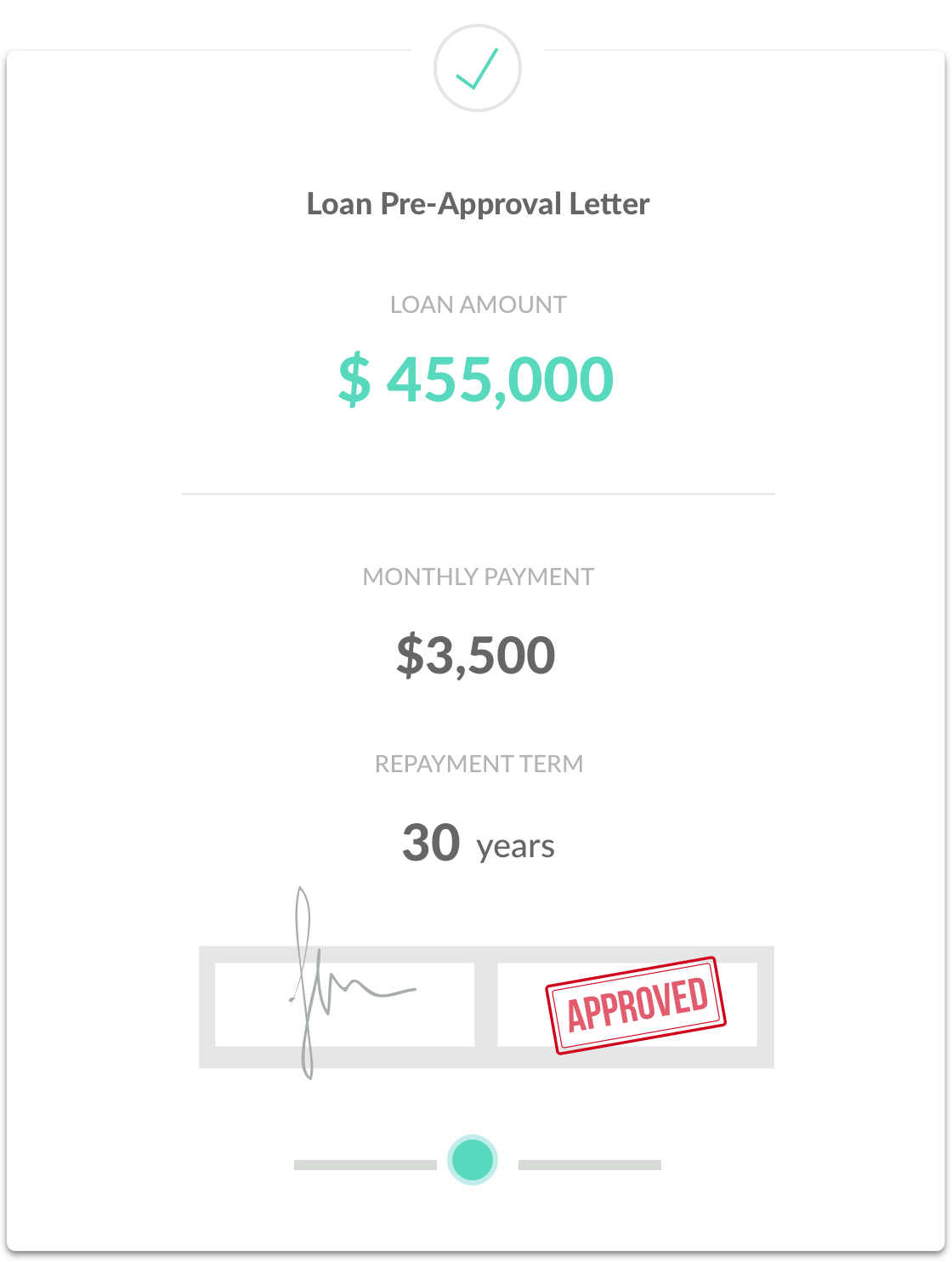

Get Pre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Application & Processing

What happens when a loan goes "live"

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Closing

Signing and Finalizing the deal

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Congratulations, happy homeowner!

Each office is independently owned and operated.

Each office is independently owned and operated.